Competitive intelligence is a two-way street. 🚦

Your internal teams serve as a primary resource in your intelligence-gathering efforts. And, in turn, your own findings help to inform these teams’ strategies.

So what tools can you use to rapidly communicate your findings to internal stakeholders? And are there any tools that can inform your own competitive projects?

Visual learners rejoice. The positioning matrix is here. 👀

These handy lil’ tools give you a canvas to paint your competitive landscape on, informing essentials such as your:

- Positioning strategy

- Value propositions

- Product roadmaps

…and a whole lot more.

What is a positioning matrix?

Ever wondered where your product sits in the competitive landscape? Enter the positioning matrix – a tool for visualizing just that. You take two comparative qualities, stick each on an axis, and plot where you and your competitors fit on those axes.

It’s like a positioning map for your competitive environment.

Note - there are actually tons of different types of matrices used in strategic marketing. Competitive matrices, SWOT analysis matrices, sales matrices… the list goes on. We’re focusing on the ‘positioning matrix’, whose closest cousin is perhaps the ‘product feature and benefits matrix’.

Take a look at this.

That’s it. Not too daunting, right?

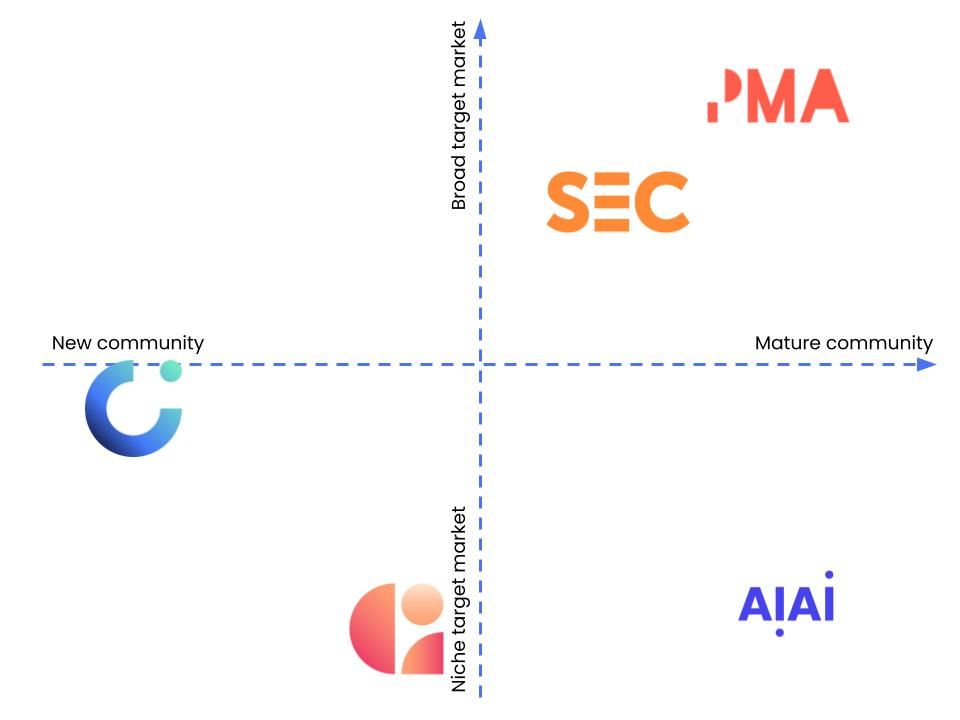

Now let’s populate the matrix and choose a comparative quality for each axis.

All done? Then you should have something that looks a bit like this. 👆

We’ve plotted ourselves and some of our sister communities according to a pair of wonderfully neutral parameters:

- The size of the target audience.

- How long the community has been around.

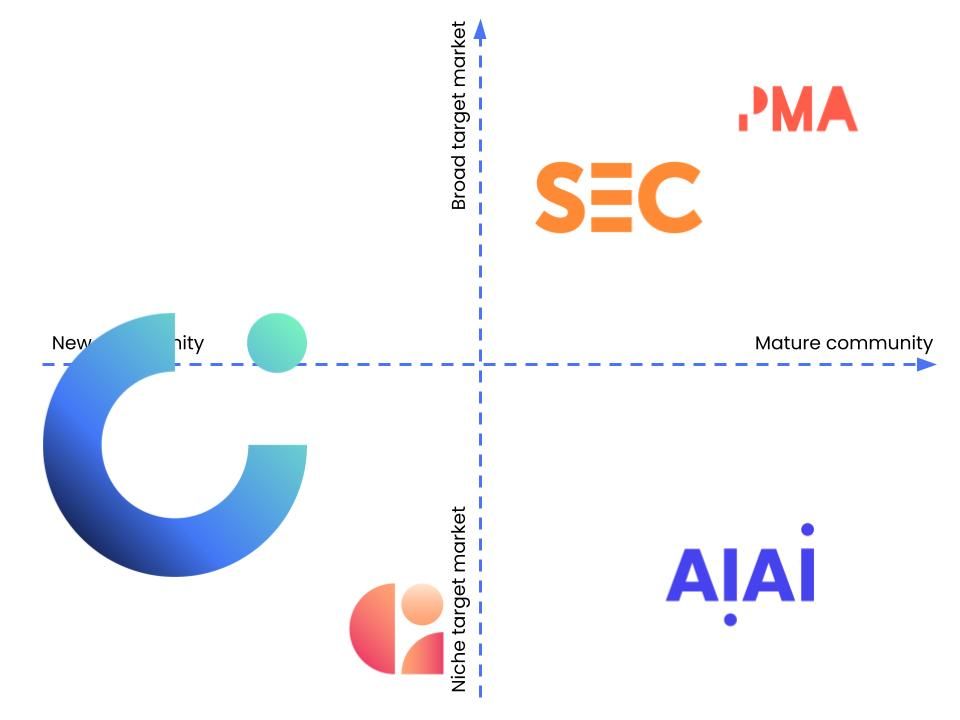

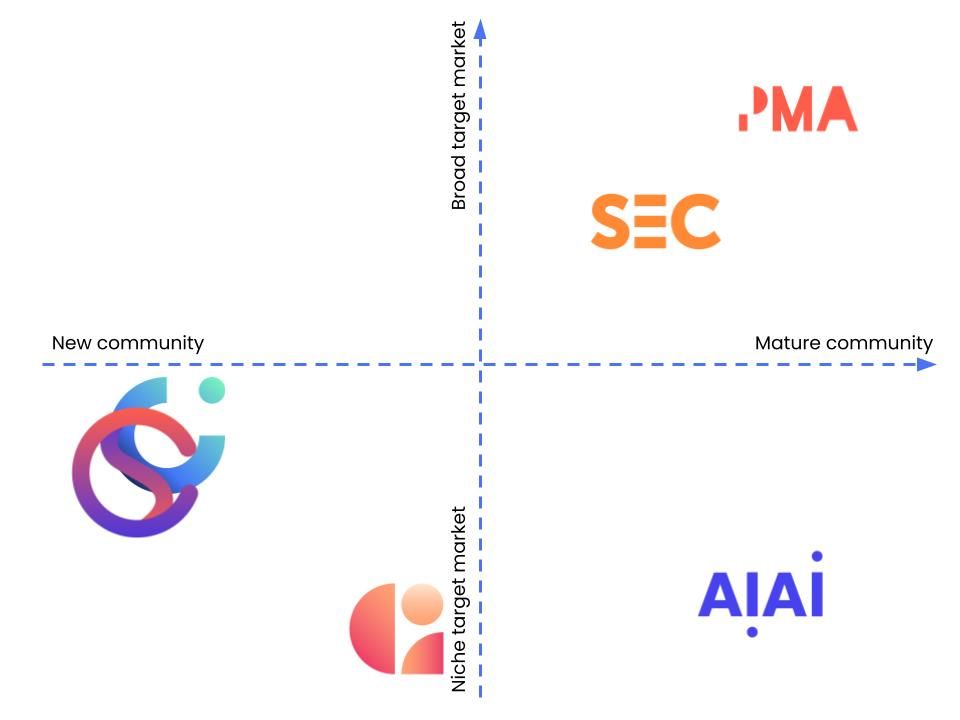

Some positioning matrices introduce a third dimension too. The size of each plotted element on the chart represents this third dimension. So if we decided to introduce generated annual revenue, or popularity as polled by the community, as our third dimension, we might get something that looks like this:

How a matrix can inform your positioning strategy

Being able to visualize where you stand amongst your competitors can inform your strategic planning.

How, you ask?

Your positioning matrix can be an early indicator when a new competitor pushes into your market share. Or, it might show you your positioning is a little too similar to an established rival’s.

From there, you might decide it’s time to review your differentiation strategy, or the finer points of your own positioning, to ensure there’s no confusion for your potential customers as to whose is the stronger product.

To achieve this, you might tweak your messaging and value proposition (in the shorter term) or your product features roadmap (in the longer term).

Ok, but walk me through it

Here’s an example.

Let’s say you provide accounting tools for businesses. You’ve learned of a few new disruptors in your sector. They’re using automation tech to meet the customer’s needs more quickly and cheaply. But you’re an established player, with a competitive position driven in part by your mature onboarding process and the ease of use you provide for large clients.

You decide to plot these disruptors on your positioning matrix, in light of your market research into their product, brand positioning, and messaging.

You find that one of these disruptors sits uncomfortably close to you on the matrix.

This informs your positioning strategy immediately.

Since this new disruptor is trying to push into your market share, you can choose to take steps (through messaging, product development, and marketing strategy) to clearly communicate your competitive advantage versus this new player.

Alternatively, you might decide no response is necessary, or you might instruct the head of your competitive intelligence program to gather more intel on this competitor.

In other words, a positioning matrix can highlight those competitors over whom you should work to secure or strengthen your competitive advantage.

• Guide to implicit market segmentation

How to create a positioning matrix

Here’s how to create a positioning matrix:

- Launch your favorite graphic design tool.

- Draw a pair of lines, or arrows, as axes.

- Label those axes with your comparative qualities.

- Plot yourself and your competitors on the matrix.

It really is that simple. But what tool should you use? And what should you be comparing anyway?

What software can I use to create a positioning matrix?

You don’t need anything fancy. You just need to be able to get what you see in your head onto the screen.

That’s easy to do.

A bare-bones tool like Google Drawings (which we used here), works just fine. This probably doesn’t need to be briefed to your design team unless it’s an asset that won’t change for a long time. If it is, and you want it to live somewhere for the whole organization to see, then it might be worth the attention of your resident aesthetics wizard.

Otherwise, your rudimentary skills in photoshop, GIMP, or any basic wireframing tool will work.

And it’ll take less than ten minutes.

What should I compare?

A positioning matrix is a versatile tool. And the metrics you choose to compare can be qualitative or quantitative. But, since this is a positioning matrix, those metrics must relate to your product positioning. 🔑

Also, it’s a good rule of thumb to use ‘sliding scale’ metrics, where each end of the axis represents an opposite extreme, with the middle offering a neutral middle-ground.

Here are a few examples of what you might want to compare:

- Premium vs economy product,

- Niche vs broad target markets,

- Highly customizable product vs not customizable at all.

If your organization’s small and your marketing function isn’t built out yet, that doesn’t mean you can’t still benefit from a positioning matrix. It just means you’ll have to do a bit more prep work.

But here’s a trick for finding the most useful positioning qualities to compare: start with the customer.

Too often, we product marketers get so lost in the product and its latest and greatest features that we forget why the product exists in the first place.

To meet the customer’s needs.

So, if you’re stuck, ask yourself this:

How does my product aim to fix my customers’ core problems?

Brainstorm for a few minutes, and you’ll likely have a list of at least a few problems your product aims to solve.

Now, look for all the ways you’re presenting that as an experience to your customer.

Positioning ties in with how you want your customers to feel about your product and the experience you want them to have while using it. So once you’re clear on the practical need your customer wants to solve, you can delve a level deeper, get to the emotional need they want fulfilling, and look at the subtext in your existing messaging that’s hitting your customers’ emotional touchpoints.

Need an example? Here goes.

A better night’s sleep for just $5

You sell lavender-fragranced eye masks for sleeping. That’s your product, priced at $30 a pop.

You’ve positioned the product to solve the customer problem: poor sleep quality. But you’ve also positioned yours as a premium product.

You’ve identified the core, emotional customer need as one of craving comfort. They want a holistic experience, and that’s what you’ve positioned your product to provide.

After all, your product is lavender-scented, and perhaps also made of breathable, soft fabric that’s a joy to wear on your face. Even in the hot Summer months. And the copy on your website makes this clear.

So, while you might not use price itself as a comparative quality, you might set one axis on a customer-experience scale from “economy” to “premium” and place yourself near the “premium” end.